This article has links to products and services we love, which we may make commission from.

You’ve saved hard for your backpacking trip and I know you would prefer to spend money on new gear over travel insurance and vaccinations but trust me, you need to invest in both. This guide will detail what to look for in backpacker insurance and compare two leading companies: World Nomads Travel Insurance against True Traveller Insurance. We (hi, I’m Gemma, the other Scot is Craig) will discuss – cost, coverage and provide real-life examples of claiming experiences.

Do I Need Backpacker Insurance?

Easy answer, yes. If you are travelling for longer than a fortnight and are going outside of your home continent/country then it is likely that any current travel insurance that you have for free through the likes of your premium bank accounts will not cover you for a backpacking trip.

Accidents happen (mopeds in Southeast Asia), food can make you sick (Delhi belly is right of passage when backpacking!) and just because you are on the trip of the lifetime it does not make you invincible, you can still catch common flu, get rashes and if stupid, sexually transmitted diseases.

Different cultures have different laws and ways of thinking. There a lot of stray dogs in the likes of Northern Thailand and Peru in South America, these dogs can have rabies and if you get bitten you need to get to an international hospital ASAP, even if you have been vaccinated.

If you have had the rabies jag you need two doses a few days apart, if you’ve not got it, four doses over a month. How doe that fit into your dream itinerary?

A serious point I have to stress here if you do not have the correct vaccinations for the countries that you are visiting your travel insurance does not have to pay out. This means that you will be paying for your health costs yourself.

I am not scaremongering here, we write about affordable travel at Two Scots Abroad but vaccinations and insurance have to be part of your budget for travelling. If it isn’t you are not only going to be short on cash but you are also going to waste a lot of time making phone calls, sending emails and being stressed.

Case Study: Claiming in the USA

To put the price of healthcare into perspective, my friend Kaci went over her ankle at the Grand Canyon. We spent half a day waiting on treatment (we only had one full day at the Canyon), she received an x-ray and crutches. Total cost? $500 USD. Luckily she could claim this back as she had travel insurance.

As a responsible traveller, it is down to you to fork out of these important requirements for travel.

We also advise investing in a good quality medical kit US / UK which includes needles and, if like us, you like a drink, stock up on hydration tablets US / UK.

You can thank us later!

Travel insurance isn’t just about health insurance though. Plans can also include lost, delayed and stolen baggage, protection for electronics and sporting equipment and legal advice if you need it.

What Type of Travel Insurance Do I need?

You should consider the following during your research on travel insurance. The type of travel insurance you need depends on five factors:

-

How long are you travelling?

Companies cater for single and multi-trips, short and long-term travel adventures – offering one-year travel insurance packages (and up).

-

What type of activities will you be doing while travelling?

You have to be mindful that some packages do not cover high altitude hikes, diving or winter sports. These adventure activities tend to increase the price of your insurance. This isn’t a reason to leave them off your itinerary, if you are thrill seeker like me you will regret not taking the cover when you are on the road!

-

Do you have pre-existing conditions?

Not quite backpacking related but my poor grandparents are doing a cruise for their diamond anniversary and their insurance is going to cost them the same as the cruise. You have youth on your side, enjoy it! Also, your age does matter, most companies will not cover travellers over a certain age point.

Side note about conditions. If you are sh*t faced when you hurt yourself, you are probably going to get declined. If you’ve had a few glasses of wine and are in control, you might still have your claim accepted.

-

Do you intend to work while travelling?

Working holiday travel insurance is a different ballgame! Check out our FAQ section for information on WWOOFing and working.

-

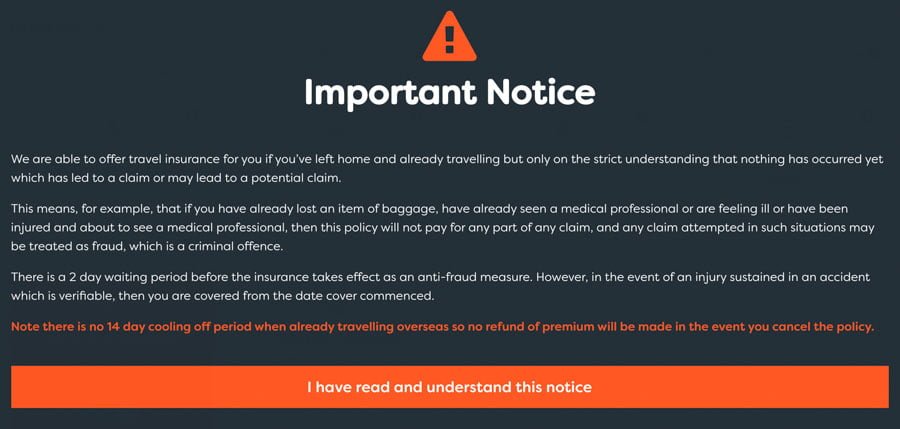

Are you already travelling?

Getting travel insurance while abroad is much harder than extending a pre-existing package but it is possible at an additional cost.

Key Terms For Travel Insurance

There are a variety of terms that you need to be aware of when shopping for backpacker insurance.

- Excess – this is the amount of money you are responsible for if you need to claim insurance while travelling. You can often pay an excess waiver to bring the amount down (just like with car insurance).

- Emergency Medical Expenses – the amount of money the insurer will pay towards your medical care, care above this amount must be paid by you privately.

- Baggage and Personal Belongings – if your bags go missing, are stolen, are damaged or destroyed, this is the amount that the company will cover (add up how much your items cost you). It is likely that there is a limit to the cost of single items.

- Personal Liability – legal expenses and liability for damage that you incurred by accident or claims made against you. It is unlikely that this will cover vehicle liability.

Companies will then offer ‘add-ons’ such as sport, adventure and extreme activities so if you want to bungee jump in New Zealand (or Scotland like we did, tandem!) you will need to add this package on to ensure you are covered. Winter sports can be added on here too and there is usually a different package depending on the duration of your ski/board trip.

Then there is usually a final tier of additional coverage such as money, individual items like electronics, sports gear, and musical instruments,

World Nomads Travel Insurance Review

There is no denying that World Nomads insurance is the most popular backpacking insurance company used by thousands of travellers each day.

Unlike True Traveller, it offers coverage to all nationalities making it very accessible to every traveller however, it is not cheap.

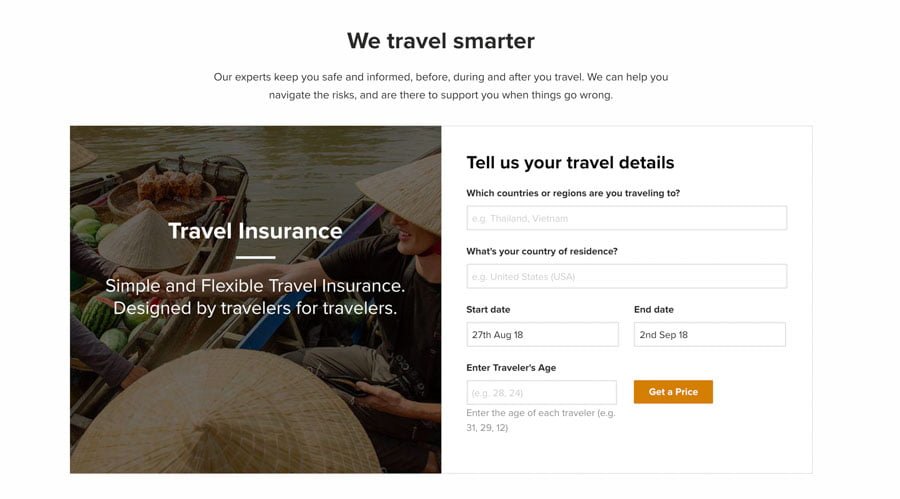

World Nomads Website

The World Nomads website initially prompts you for the following information:

- Countries travelling to (you can add multiple or ‘worldwide’)

- Country of residence

- Start and end date of the proposed policy

- Traveller’s ages

You then hit get the price button. World Nomads then throws up two pricing tiers – the ‘Standard Plan’ and the ‘Explorer Plan’.

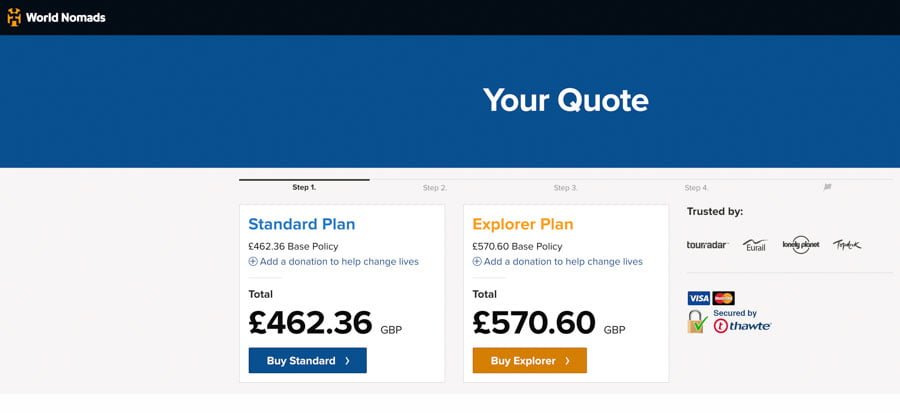

The Standard offers less and is cheaper in comparison to the Explorer.

Side note: World Nomads automatically adds on a charity donation which it defines as a ‘footprint donation’ you can increase, decrease or remove at the bottom of the quote.

One Year Travel Insurance

For example, a worldwide policy which covers one resident from the UK aged 33 (still flirting with 30!) comes in at £462 for the Standard Plan and £571 for the Explorer Plan.

The biggest differences between the two are that the emergency medical expenses coverage is £5,000,000 for the Standard but double that for the Explorer, baggage and personal belongings is also double (Standard is £1000 – with limits to single items), personal liability is £2,000,000 for both tiers and if you have to cancel your trip before you leave, the Standard World Nomad policy would not reimburse you whereas the Explorer would offer up to £5000.

World Nomads Insurance Real Example

- By Taylor from Taylor Tracks

Getting Medical Care in Developed and Developing World Countries

When I was finishing up my four-month trip around Southeast Asia I was in my last destination, El Nido, Philippines. On an island-hopping day trip, I started to feel quite weak and tired but I blamed it on pushing so hard for the past four months of travel and shrugged it off as I was going home in a week.

The next morning I woke up with a raging fever so I decided to try and sleep it off. Three days later and the fever was only worsening (40°C/104°F), my throat was the sorest it had ever been and my ears felt blocked.

I had the front desk call me a ride and I landed myself in a dusty doctors office where I learned that I had tonsillitis and wax build-up in my ears (most likely from wearing earplugs).

I was prescribed some antibiotics for tonsillitis and some drops to help my ears which cost around $100 CAD/$77 USD/ £50 which was more expensive than I thought it would be for the Philippines.

I went back when the fever didn’t break after another two days and got stronger antibiotics and my ears were cleaned out (thank goodness because I had 24 hours of travel two days later!). All ended well and I was able to travel home healthy though tired.

A year later I found myself sick with a fever yet again but this time in Australia, attempting to enjoy the beaches with chills.

I did everything I could to get rid of it, rested in my hostel dorm for a few days and took medication to get it to go down but nothing helped.

Once in Sydney, I got myself an appointment at the closest clinic, worried because my sinuses were completely blocked and I had 5 flights within the next week.

The doctor saw me with no issues ($75 AUD/ $55/ £43 fee just to see a doctor), prescribed medication for a sinus infection and recommend a nasal spray. Luckily I was fully cleared before my flight to camp in the outback.

Claiming Through World Nomads

I’m happy nothing was more serious and though I could have easily covered the expenses myself I still claimed them through World Nomads on both occasions, including the medication I bought that wasn’t prescribed by the doctor.

I logged into the World Nomads member area on their website, selected ‘make a claim’ and entered all the information that was asked for including copies of the recipes that I got on both occasions. Within a month I had a cheque waiting for me in the mail with a full reimbursement.

True Traveller Insurance

True Traveller travel insurance is aimed at residents in the UK so this excludes a number of travellers. However, for those in the UK, you will find that True Traveller is cheaper than World Nomads but does not scrimp on service.

My friend Karen is an over-planner. Karen will research every possible aspect of a trip before leaving and have it documented for leaving (you won’t be surprised to hear that her partner, Craig, is super laid back and does not plan a thing). Karen and Craig’s travelling pattern is pretty similar to mine and my Craig’s.

Karen and Craig were leaving for Canada before us so had all of their travel insurance nailed before us.

She passed on her notes with True Traveller coming out on top because of their affordable price and winter sports coverage.

Never one to rely solely on others advice, I spent days researching the possible insurance companies for our 18-month career break to travel the Americas and Europe, creating pages and pages of notes and tables.

Again, True Traveller was coming out on top so I called them (twice) to probe for reassurance (I’m anxious) and they were patient with me and my variety of questions each time (I am not your ideal customer).

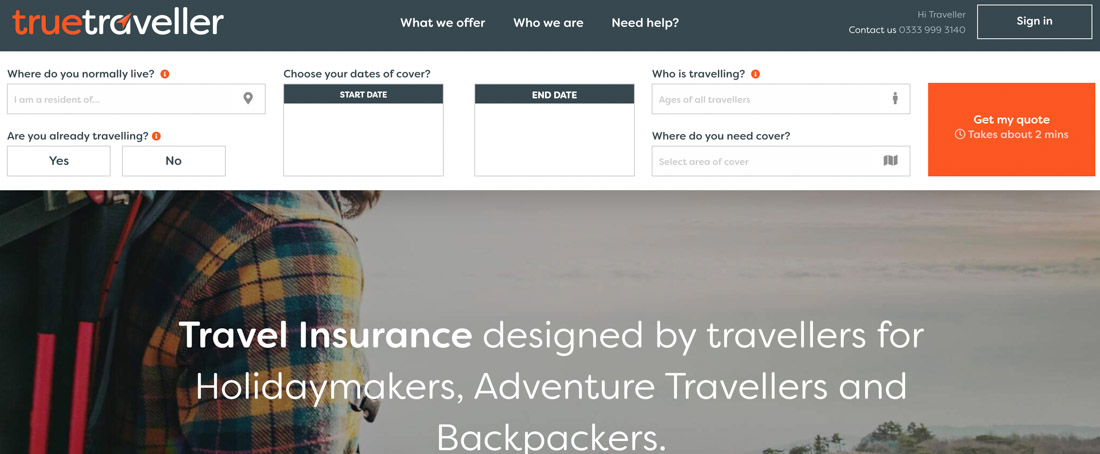

True Traveller Website

The website asks you to complete the following criteria

- Where you live

- Are you already travelling?

- Dates which you would like the insurance

- Ages of travellers

- Area of cover – Europe, Australia and New Zealand (duration sensitive stopovers included), Worldwide excluding USA/Canada (duration sensitive stopovers included), Worldwide (all countries)

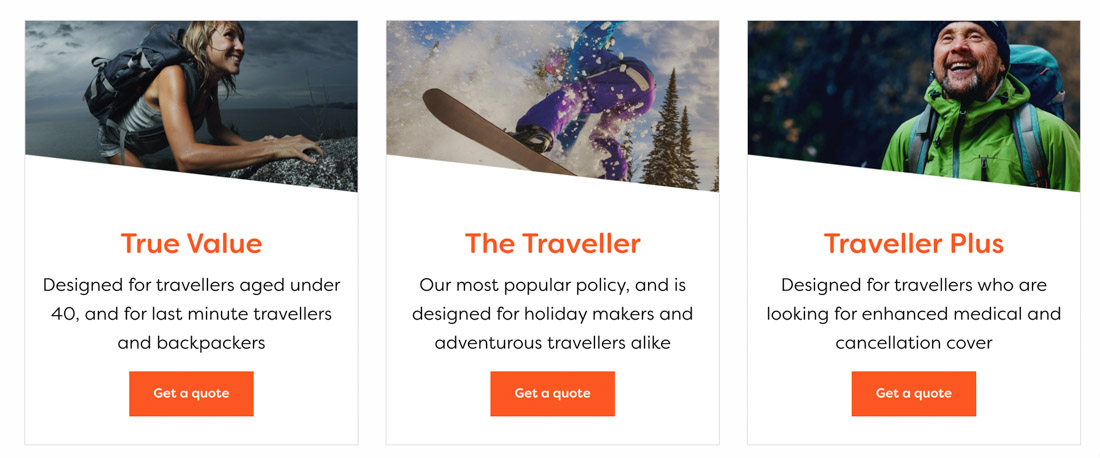

The very neat site retrieves a quote which offers three price tiers.

- ‘Traveller’ is the most popular middle of the road policy.

- ‘True Value’ for cheap backpacker insurance, ‘no-nonsense budget policy.’

- ‘Traveller Plus’ offers higher medical cover as well as cancellation options.

One Year Travel Insurance

If we look at the example of a one year, worldwide package for a traveller aged 33 who has not left yet the price comes in at £299.99 for True Value, £393.29 for Traveller and £490.17 for Traveller Plus.

The biggest differences between the three tiers are that the True Value covers less medical expenses (£2,500,000 compared to £5,000,000 for the second tier, Traveller), optional baggage (£1000 compared to £2,000,000 – with limits to single items), personal liability (£1,000,000 compared to £2,000,000) and offers less cancellation coverage if you have to cancel your trip before leaving your home country (£1000 compared to £3,000,000).

The upper tier, Traveller Plus, naturally offers more but costs more.

Companies offer three tiers to accommodate all budgets but also from a marketing angle, most shoppers choose the middle tier. Craig is a gas engineer and does the same when he is quoting for boiler changes (thrilling eh?!)

True Traveller also offers insurance add-ons for:

- Sports/activities at differing levels from everyday football playing to extreme skydiving. This is the section you need to consider the altitude of hikes in. For example, the Extreme Pack cover altitudes over 4500 metres which were essential for us for our Peru treks.

- Winter sports with two different options depending on how long you plan to ski/board for.

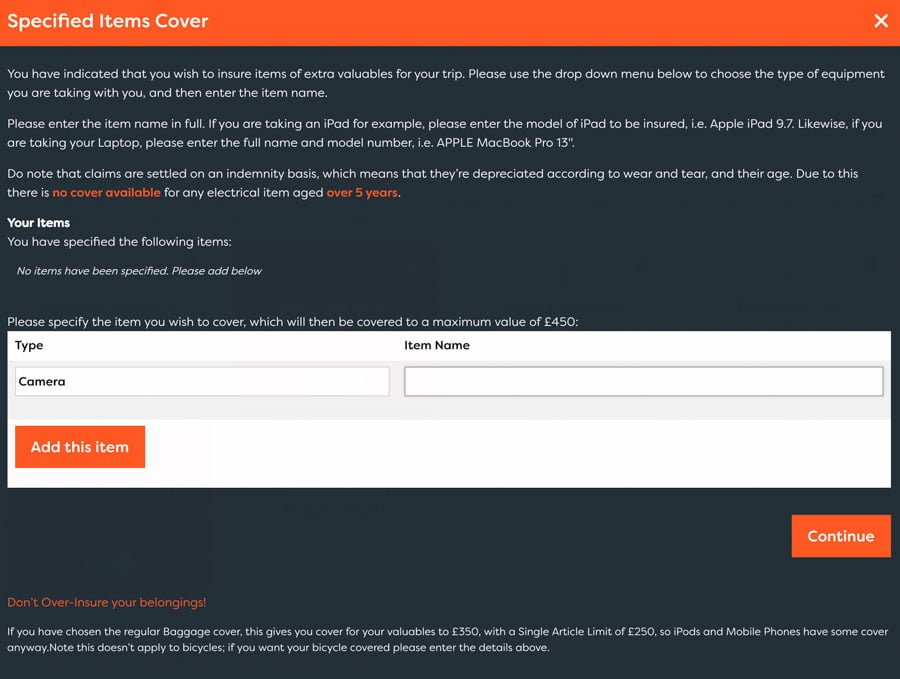

- ‘Baggage, Money & Documents’.

- ‘Specified Items’ such as electronics, sports equipment and musical instruments.

- ‘Travel Disruption’ – this avoids getting fobbed off with the ‘act of god’ excuse.

- ‘Travelling One Way’? Many companies won’t cover you if you can’t prove you have a return flight – True Traveller will – tick the box to see the cost.

- ‘Already Travelling’? See below section.

Accessing Medical Care Abroad

While living in Vancouver I started to feel dizzy every time I moved from lying down to upright.

Being dramatic, I automatically thought the worst – pregnancy. That was ruled out so I increased my water intake to combat dehydration and cut downtime on the laptop.

When that didn’t work, my medic friend advised me to seek help. I went along to a walk-in GP (with my passport which is essential for ID) who priced the visit at $100 CAD/$77 USD/ £50.

I then bailed after my friend asked via text if I had checked my blood pressure (I really did not want to part with this cash!)

A quick trip to the blood pressure machine at the pharmacy later proved that analysis incorrect – I was healthy so it was back to the GP.

The doctor saw me promptly, asked a few questions, did some eye focus test and felt around my head and shoulders.

The diagnosis? Blogging was causing the dizziness.

Thankfully I was referred to a physiotherapist because that diagnosis was a heap of crap, I had Benign Paroxysmal Positional Vertigo (BBPV) also known as ear crystals.

At $100 CAD a pop, the physio trip was worth the cash – we worked out the ear crystals (I’ve never had repeat issues) and also looked at my posture from working on the laptop all day (I now have an office at home with a desktop setup).

Claiming Through True Traveller

I retained all the receipt and claimed for the GP visit and the two physiotherapy treatments.

The claim was easy, I used the website ‘make a claim’ section, uploaded copies of the receipts to a provided email address, accepted the waiver fee of £75/$95 and was paid the remaining £74/$96 within three weeks.

You can read more about me claiming in detail here.

Booking Travel Insurance While Abroad

As mentioned above, respectable travel insurance companies will allow you to start a policy which you are already travelling but it will cost you a bit more and comes with the warning that you cannot claim for previous issues.

If we take our previous one-year trip example, ticking the box to say that you are already travelling will add on £30.

I know this does not sound a lot just now while you are looking for insurance but when you are on the road, country depending, this could be one day’s budget. Craig and I survived off £35/$45 per day each on average.

Also, if you are travelling and your policy is about to run out, True Traveller emails to ask if you would like to extend.

Backpacker’s Insurance For Pre-Existing Conditions

If you have a condition already, it doesn’t mean you won’t get insured. If just means that you need to complete the basic search on True Traveller or World Nomads and then call the medical screening teams to discuss further.

FAQs

-

Is cheap backpacker insurance worth it?

Insurance is like travel gear, it is something you need to invest in. If you don’t need to claim during your travel then cheap insurance is worth it but that’s the risk you take!

-

What is the best long-term backpacker insurance?

‘Best’ comes from personal experience. I can vouch for True Traveller because they paid out in a timely manner and they have 5 stars on Trustpilot. World Nomads has 3 stars but I know that lots of backpackers purchase it and you can read Taylor’s two examples of claiming above.

-

Can I buy 2-year travel insurance?

Sure, True Traveller’s search function allows you to search for two years, World Nomads caps at 18 months.

-

What about travel insurance for electronics?

Most insurers cover electronics up to a limited value amount which is usually low. For example, World Nomads will cover £100 on their basic tier but no tablet, laptop or phone for that matter is that cheap. Some insurers off additional coverage but again this will not cover a £1000 laptop. World Nomads does offer digital nomad cover package, see here to read more. I have not used it personally.

-

Can you order travel insurance after departure?

Yes, see the above section on Travel Insurance While Abroad.

-

Do I need separate work insurance?

It is not a given that you can work or volunteer with travel insurance. True Traveller does offer farm work protection through the likes of Workaway or WWOOFing if you choose their Adventure Pack. They also cover the 2-year IECC Canadian work programme which is great because one of the stipulations is that you must have insurance at border control.

-

What happens if I am intoxicated?

This is assessed on a case by case basis. If you need to your stomach pumped or are arrested at the time of the claim it is unlikely you will have your claim accepted. If you’ve had a few wines and are still compos mentis you might be get accepted.

-

Can I trust backpacker insurance reviews?

This is an important question. Most insurance companies have affiliate schemes so websites can make a small commission on sales and rightly so, no one should pour days over creating great content for readers without some form of payment but the reviews must be trustworthy.

As mentioned above I have not used World Nomads but Taylor has (I also asked in a female travel Facebook group and out of the five respondents, only one had a denied claim and she said she agreed to an extent) and the True Traveller experience is 100% honest.

Final Thoughts On The Best Backpacker Insurance

The best travel insurance for backpackers really comes down to personal experience, budget and the reasons for needing insurance. This guide has detailed real-life examples of two of the popular insurers on the market and well as setting out the terminology to look out for when shopping. The main takeaway from this guide is not to get caught out, research and book before you go for a stress-free adventure!

Planning a trip?

Pin to your travel planning board.

World Nomads won’t cover you if you have a medical condition; no one to phone 🙁

Thanks for heads up Chris, I’ll investigate and get back to you. Are you in Europe? True Traveller definitely does look at it case by case.

Hi Chris, WM got back to me and asked for you to check their

helpdesk here.